No fees or commissions apply. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares.

Fidelity Drip Fidelity Dividend Reinvestment Plan 2021

A DRIP plan with the ETF does just that.

Dividend reinvestment plan etf. Whether ETF dividends are automatically reinvested depends entirely on your broker. An ETFs minimum is the price of a single share which could be as little as 50 depending on the ETF. DIVIDEND REINVESTMENT PLAN Given the costs associated with trading ETFs have not always been best suited for investors looking to continuously reinvest cash distributions received from their portfolio.

Its an automatic arrangement that is set up by a broker and is a plan offered by. ETFs have lower investment minimums. The Dividend Reinvestment Plan DRIP allows you to automatically reinvest the cash dividends 1 you earn from your equity investments.

It reinvests dividends paid by a mutual fund stock or ETF into more shares or units of that same mutual fund stock or ETF. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. Instead those dividends will be used to purchase additional shares of stock in the company that paid the dividend.

A dividend reinvestment plan does just what its name suggests. Select Full Participation to enroll in the Dividend Reinvestment Plan. This no-fee no-commission reinvestment program allows you to reinvest dividend andor capital gains distributions from any or all eligible stocks closed-end mutual funds exchange-traded funds ETFs FundAccess funds or Vanguard mutual funds in your Vanguard Brokerage Account in additional shares of the same securities.

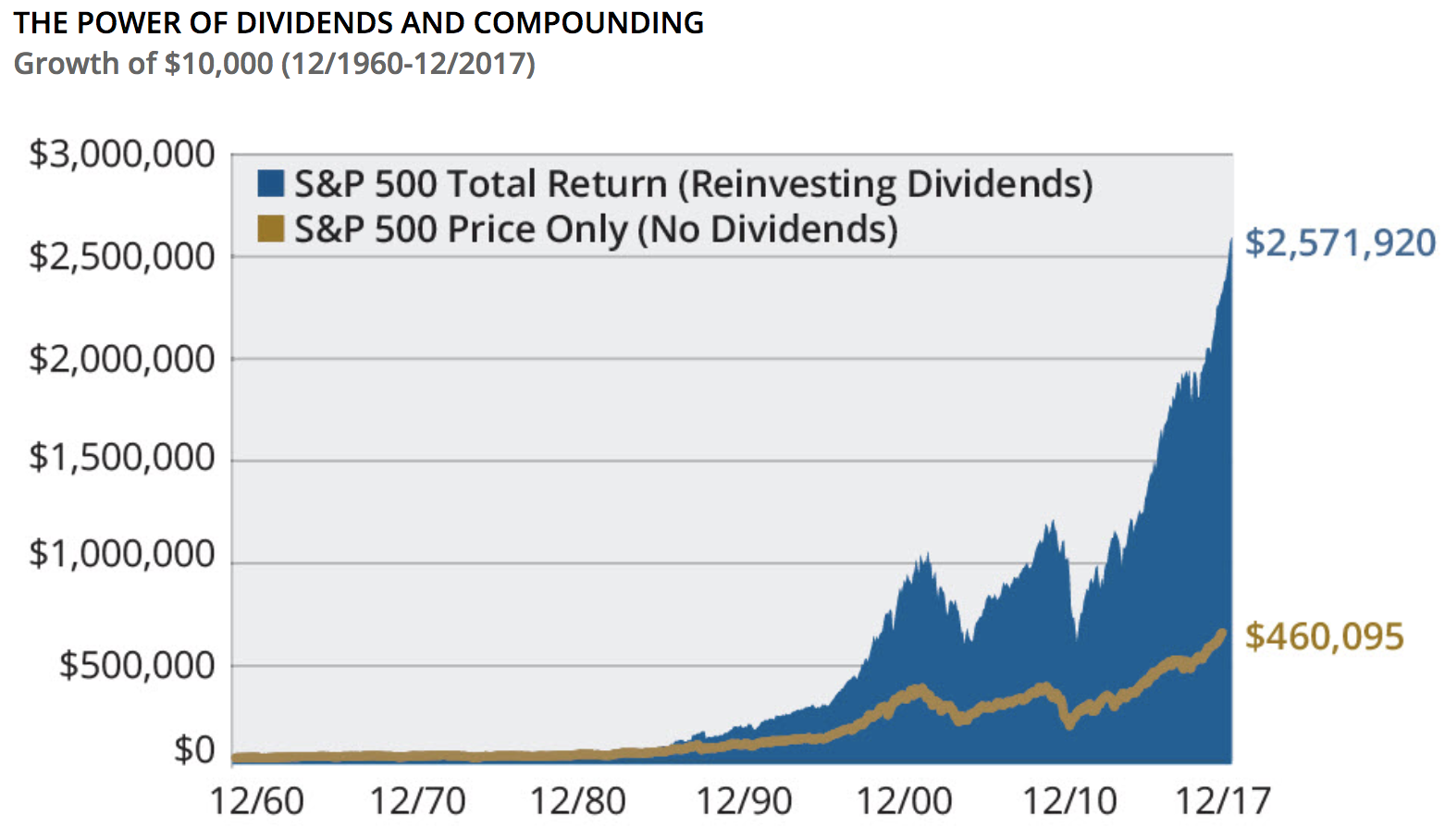

A dividend reinvestment plan DRIP is an arrangement that allows shareholders to automatically reinvest a stocks cash dividends into additional or fractional shares of the underlying company. For example lets say you own an ETF that aims to pay 2 of your investment back to you once per year. Dividend Reinvestment Plans DRP Explained A distribution reinvestment plan or DRP is the same thing as a dividend reinvestment plan for shares.

With this system once an accounts cash balance reaches 10 the free cash balance is automatically invested in Pies. An automatic dividend reinvestment plan DRIP is simply a program offered by a mutual fund ETF or brokerage firm that allows investors to have their dividends automatically used to. IVV distributes dividends on a quarterly basis.

Once enrolled your ETF dividends will be automatically reinvested. When an investor enrolls in a dividend reinvestment plan heshe will no longer receive dividends in the mail or directly deposited into their brokerage account. IShares does not break down the performance of their ETFs into Capital Gains and Dividend distributions so the historical dividend yield of IVVis not readily available.

ETFs have more transparent pricing. Now the next time that your ETF shares issue a dividend rather than. A DRIP or a dividend reinvestment plan is a program where investors can reinvest cash dividends to purchase additional shares of the stock on the dividend payment date.

A Pie is a basket of investments either stocks or ETFs or a combination. ETFs provide real-time pricing so you can see their prices change throughout the trading day. After clicking next a couple of times you are now enrolled in the dividend reinvestment plan.

ETFsActive ETFs allocation under the Plan 61 Rights attached to ETFActive ETF units ETFActive ETF units issued under the Plan will be credited as fully paid and rank equally in all respects with existing ETFActive ETF units as from the date of issue. A mutual fund may require 1000 3000 or more to get started. On this screen you can choose your participation level.

Instead of a Dividend Reinvestment Plan M1 Finance offers something called auto-invest. RBC Direct Investing purchases shares 2 in the same companies on your behalf on the dividend payment date. The IVV Dividend Yield is 169 as of 30 November 2019.

You may receive a letter in the mail confirming your change in reinvestment plan option. With most brokers such as Vanguard TD Ameritrade and Robinhood you will be able to enroll your dividend ETF holdings in a Dividend Reinvestment Plan DRIP. 62 Time of issue ETFActive ETF units to be allotted under the Plan will be issued within the time required by.

There is a dividend reinvestment plan available for IVV. It provides cash the dividends you are paid back to the fund manager who will accumulate all such reinvested dividends and proportionally buy more shares of stock in the ETF. A dividend reinvestment plan DRIP is a program that allows investors to reinvest their cash dividends into additional shares or fractional shares of.

A Guide To Dividend Reinvestment Plans Drips Intelligent Income By Simply Safe Dividends

The Pros And Cons Of Dividend Reinvestment Plans Sharesight

How To Set Up The Dividend Reinvestment Plan Drp Etf Bloke

How To Set Up The Dividend Reinvestment Plan Drp Etf Bloke

How To Set Up The Dividend Reinvestment Plan Drp Etf Bloke

Dividend Reinvestment Plans Drp Explained Best Etfs

Are Etf Dividends Automatically Reinvested Marvin Allen

Questrade On Twitter Are You Aware Of The Long Term Benefits Of Reinvesting Your Dividends Using The Dividend Reinvestment Plan Aka Drip Check Out These Examples To See The Power Of Drip Over

Dividend Reinvestment Plan Simple Steps For A Retirement Portfolio Course Youtube

Dividend Reinvestment Plans Drips Secret For Investing Success

How To Track A Dividend Reinvestment Plan Sharesight

Vanguard Drip Vanguard Dividend Reinvestment Plan 2021

The Dividend Dilemma Should You Reinvest Or Take The Ticker Tape

What Is A Dividend Reinvestment Plan And How Does It Work

Dividend Reinvestment Plans Drp Explained Best Etfs

Dividend Reinvestment Plan An Amazing Long Term Investment Option Wealthface

Dividend Reinvestment Plan Advantages And Disadvantages Fsmsmart Reviews